Dollar cost averaging is an effective strategy for saving towards making large purchases such as tuition fees, houses, cars and investments. As we all know, it can take a great deal of time to save for these larger purchases. As expatriates living in Indonesia with contracts lasting anywhere between 12 and 24 months, it may be difficult to save enough for large purchases such as tuition for university or college due to the relatively short investment horizon. If your choice of saving includes high risk investments such as stocks, it is a real possibility that your savings efforts may leave you with less money than you originally started out with. But with careful planning and commitment to reach your savings goals, it is possible to maximise the amount that you accumulate from your investments by taking advantage of dollar cost averaging.

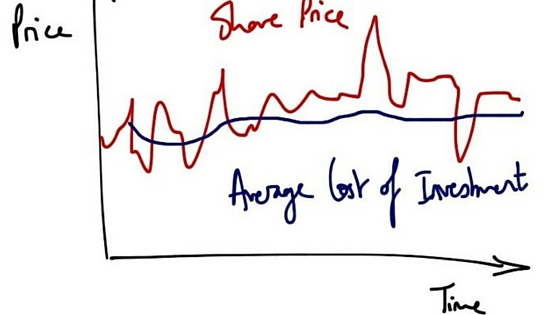

Dollar cost averaging is based on the concept of investing small amounts over longer periods of time rather than investing larger lump sum amounts on a single occasion in order to minimise the effect of negative market swings. But how exactly does dollar cost averaging work? Firstly, the investor commits to investing a predetermined amount in a particular stock on a regular basis over an established period of time. For example, let’s suppose that an expatriate wants to save $30,000 towards university tuition over a 24 month period. When this amount is divided equally, it works out to $1,250 each month for 24 months. What the investor would do is to invest amounts of $1,250 each month towards purchasing mutual funds. If the share price of the stock increases, it means that the investor will be able to purchase less shares but the overall value of his portfolio would increase since the average share price would increase. On the other hand, if the share price falls, the investor would be able to purchase more shares and the overall value of his portfolio would fall. If this investor had invested the full $30,000 at the beginning of the year and the stock price fell by 10% by the end of the year, he would have made a 10% loss on his investment, all other things being equal. However, if he had invested using dollar cost averaging, if the share price fell at any time during the investment period, the overall impact would not have been as great since the size of the overall portfolio would have been smaller.

Dollar cost averaging is therefore an excellent way to reduce market risk regardless of whether the market is up or down. Even if the market ends with share prices down, with dollar cost averaging, the investor could still potentially make a gain at the end of the period. To benefit optimally from dollar cost averaging, the investor must be prepared to invest long term. An additional advantage of dollar cost averaging is that the investor has the opportunity to change his investment options if the share price for the stock being invested in continues to decline in value over several months. The investor may choose to invest in another stock that is experiencing increasing returns in the marketplace.

Dollar cost averaging is an effective method for reducing overall risk. Investors who are not prepared to lose any of their investment capital may be better off investing in safer security instruments such as government bonds or mutual funds rather than stocks. For expatriates looking to save, dollar cost averaging can help you to reach your savings goals with minimal risk.

Book a Consultation